Analog Units: Declining Running Metrics Give Me Pause

Czgur/iStock via Getty Photographs

Looking for lengthy-term compounders, Texas Instruments (TXN) is a title that consistently pops up on my screens. However, the analog chip sector has several names deserving of further more exploration, which includes Analog Gadgets, Inc. (NASDAQ:ADI).

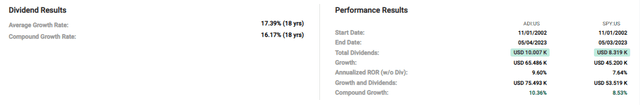

Quickly Graphs

The company has overwhelmed the market place in excess of time, even though not at a blistering pace. There are a number of things operating in their favor. While analog chips can be very impacted by the business cycle based on end-use instances, the all round margin image is fairly helpful. Significantly less capital has to be used on exploration and progress thinking about analog chips aren’t in the exact same race to the smallest possible factors prevalent somewhere else in the silicon room. Additionally, the chips are not expensive, so prospects usually are not extremely price delicate and glance much more to a company’s reputation for good quality. This signifies the best providers in the area, with the greatest scale and SKU loadout are possible to gain business enterprise. When the chips are crafted into goods, several for a longer time-leg goods will retain the exact same chips vice jeopardizing yet another round of screening to help you save a few of pennies for every device.

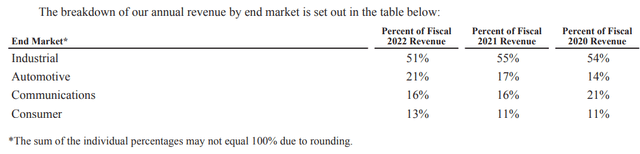

10-K

ADI is hugely uncovered to the industrial industry, in the sort of sensors, actuators, energy administration, and other works by using. Analog chips typically change a actual-earth signal like temperature, stress, audio, light, or movement into a electronic one for use in an built-in circuit. In the industrial section, the development to automation and extra technologically superior amenities need to be a boon for ADI. The company’s publicity to the EV market place with electrical power administration chips is a powerful progress vector in its Automotive device, as evidenced by the bigger portion of complete profits that section has grown to about time. The company’s communications goods generally transform voice to a electronic sign in cellular infrastructure, however the enterprise has small over-all exposure to the cell cellphone and individual electronics market place.

ADI has been acquisitive above time. Commencing with the acquisition of Hittite Microwave for RF chips in 2014, the corporation acquired Linear Tech in 2017, and the most new acquisition of Maxim Integrated and its electricity management chip catalog was a whopping $28B. The enterprise has taken important techniques to therapeutic massage its solution catalog to many end marketplaces administration sees as having a shiny long term, including electric powered vehicles. Having said that, as we will seem at in a bit, these acquisitions have not always pushed the working metric gains buyers need to want to see.

Recent final results were being good, all round. Revenues grew 21% yoy on the back of 29% development in the Automotive phase. Earnings ended up up 42% yoy to $2.75 per share. Gross margins came in at 74% (non-GAAP), up 170 bp’s yoy, and working margins came in at 51.1% (also non-GAAP). Wanting previous the GAAP adjustments, the margin profile is excellent, and profits expansion at this price would be wonderful if it had been sustainable. Nevertheless, much more than most likely profits expansion will tail off to mainly flat about the future two several years. Below were being a few of the large details from the earnings phone:

Very first, industrial and automotive providers have announced extra than $300 billion of investments in greenfield gigafactories, critical to the output of batteries to proliferate the electrification ecosystem. These gigafactories will drive further need for our formation and check options crucial to making higher density batteries. Further, supplied the inherent protection dangers of working with larger mobile voltages, these factories will also give new advancement vectors for ADI.

In our sustainable strength franchise, we are leveraging our market-primary automotive BMS solutions into electrical power storage systems for electrical grids and rapidly-charging infrastructure. We have won designs at primary EV infrastructure suppliers in North The united states, Europe and Asia, placing us on a path to much more than tripling this business enterprise in the coming yrs.

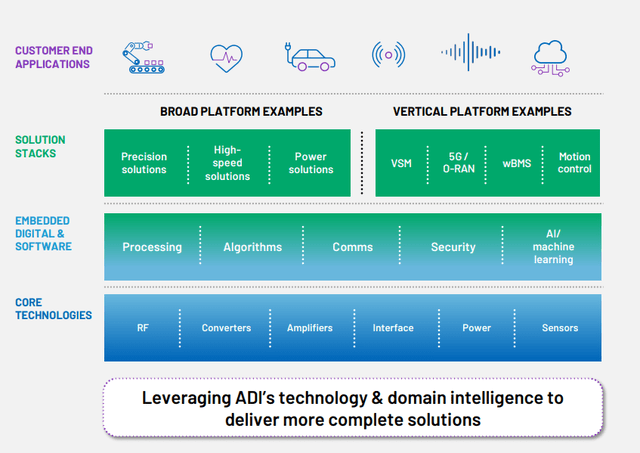

Corporation Presentation

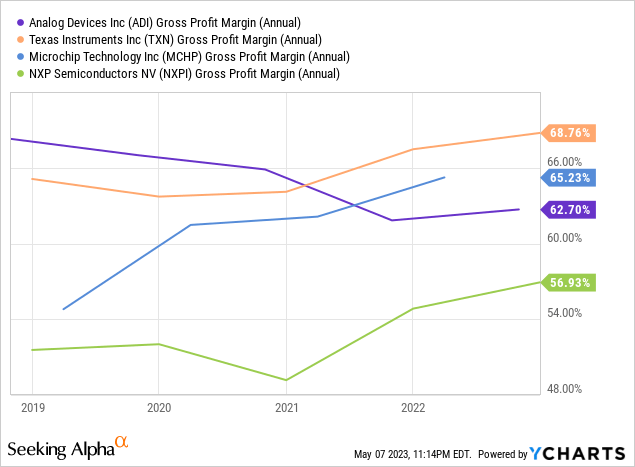

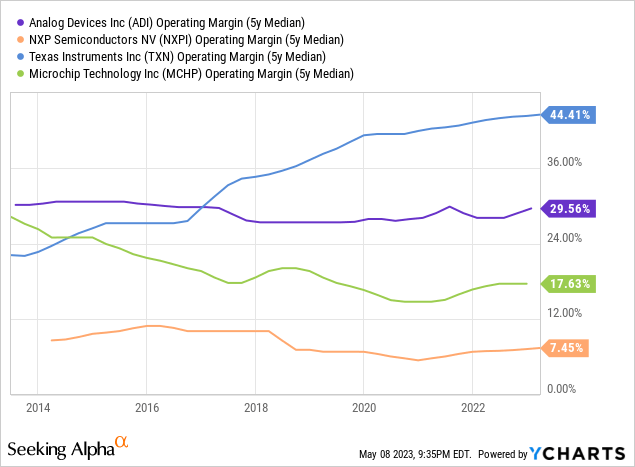

Amongst a choose group of chipmakers, ADI’s gross margin profile is relatively in-line. TXN is trending increased although ADI has trended lower, but the 60% vary appears to be like a superior 1 to be in between this team of companies. It really is significant to keep in mind these chipmakers provide distinct conclusion marketplaces, but ADI has intent-designed its item portfolio and amongst a peer team, I might be most fascinated in the firms with the ideal over-all margin picture.

The operating margin photo is a very little distinct, nonetheless. These numbers from YCharts are GAAP, so you may detect you can find a obvious disparity between the 4 corporations. TXN has pushed large operating margin growth about time, whilst ADI has taken care of a fairly more constant degree of about 30%.

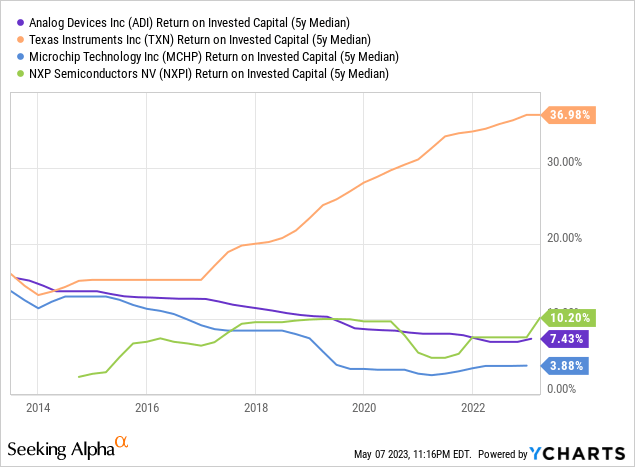

Seeking at returns on invested capital over a 5-calendar year median, ADI has trended down in excess of time to a somewhat abysmal 7.4%. This has been a very acquisitive company more than the past 10 years, which includes the massive invest in of Maxim Systems in 2021. Having said that, based on declining returns on invested cash, including in some scenarios underneath the weighted regular price of capital, trader value has actually been destroyed as a result of some of these investments in my check out. Balancing that towards the definitely spectacular ROICs exhibited by TXN, and it truly is quite evident to me which organization I’d relatively individual.

Nonetheless, you can find often a price to be compensated for that sort of achievements. ADI carries on to ebook enormous acquisition expenses which have compressed margins more than time. Due to the fact 2017, the organization has booked in the neighborhood of hundreds of tens of millions of dollars for each yr in acquisition fees, including most not long ago in 2021 with $1.33B. Once the company is by means of these integration prices, I might be expecting to see a rosier picture, or at minimum one particular nearer to the company’s non-GAAP reported metrics.

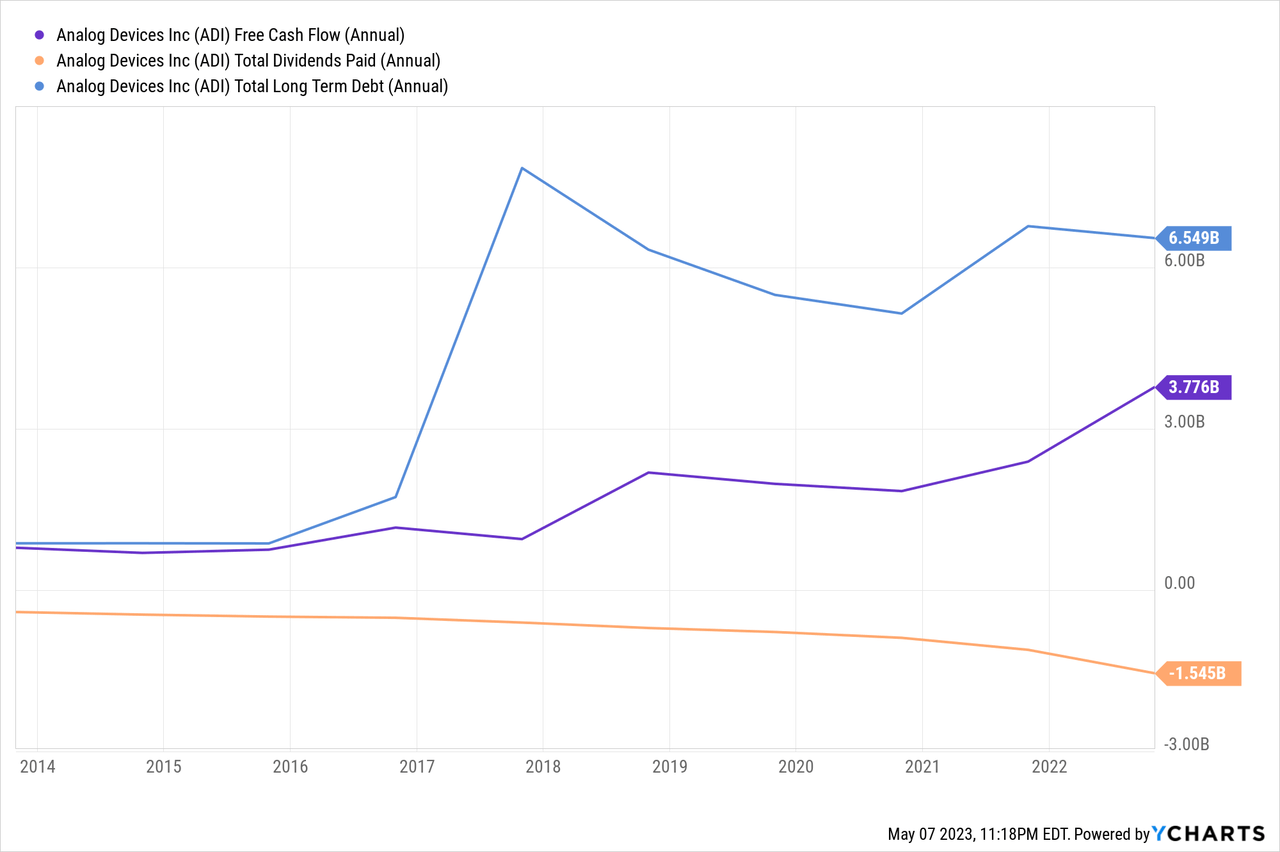

The equilibrium sheet is not in a bad place, all matters deemed. The company has hiked the dividend every single 12 months for 21 consecutive yrs, and is committed to prolonged-phrase dividend growth at a 10% clip. The dividend is well included by no cost income flow, and irrespective of the acquisitions, the long-term financial debt is also conveniently serviceable by cost-free dollars flow.

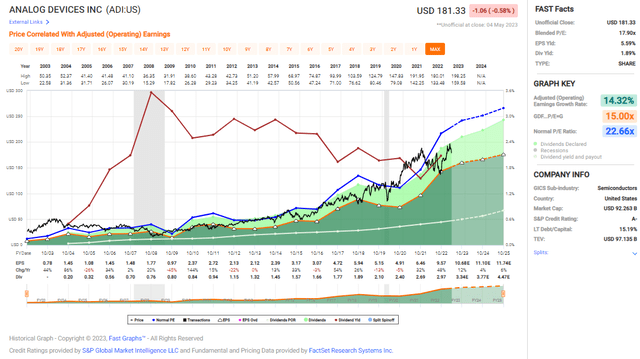

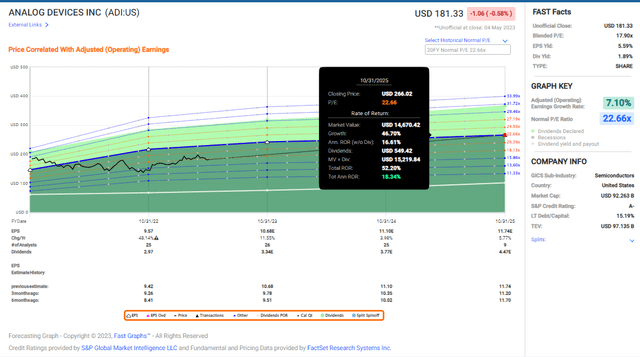

Speedy Graphs

Hunting at the very long-time period earnings graph, the company’s earnings expansion rate has outpaced extensive-time period returns at 14.32%, a indication of a healthful compounder. The firm booked modified earnings declines in 2009, 2012, 2016, 2019, and 2020, which is a little less excellent to see and reveals the cyclical nature of the company.

Rapidly Graphs

Looking at the anticipated earnings development costs over the up coming couple years and a return to about 22.66X earnings, an expenditure right now could generate all-around 18% annualized complete returns. Even so, this accounts for very a little bit of numerous expansion, which I would be expecting to arise most most likely with an improvement in the over-all macroeconomic photo.

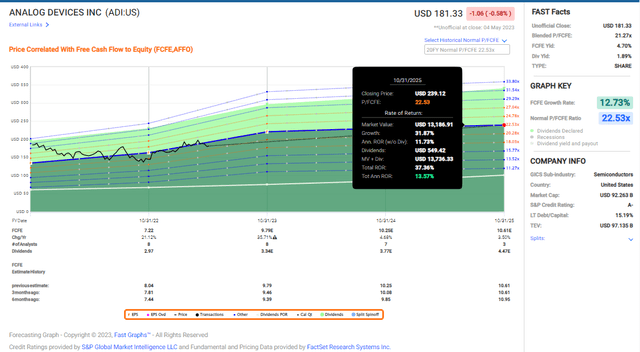

Rapidly Graphs

Seeking at absolutely free funds flow advancement and a return to about 22.53X FCF, an expenditure now could yield nearer to 13.5% annualized.

Both equally the free hard cash circulation and earnings growth graphs clearly show ADI to be at all over fair price, with possibly a compact margin of basic safety. The company operates in many markets that should really love secular progress gains above the coming decade. Acquisitions and connected prices have compressed running metrics, and returns on invested capital are weak at best. However, the advancement prospects are good regardless of brief-time period profits development remaining fairly flat. If you have been eyeing the enterprise, now’s not a bad time to average in, but I would relatively take a more time look at TXN. ADI is a keep.