How SoftBank’s highly-priced bet on the “Internet of things” backfired at Arm

Bloomberg | Getty Visuals

As Masayoshi Son attempted to persuade traders of the wisdom of obtaining a single of the most successful chip organizations in the world in 2016, the SoftBank chief had one particular very clear information: “For the period of the ‘Internet of things’, I feel the champion will be Arm.”

But the concept of connecting billions of everyday and industrial devices to the Internet has been a great deal slower than expected to materialize.

Son’s generate to capture the chip style and design market for the Web of items (IoT) was the first wager he produced on Arm that has not compensated off. The 2nd was a $66 billion sale of the business to Nvidia that unraveled previous week.

Arm stays the dominant participant in coming up with chips for smartphones, however the most ubiquitous variety of computing but a supply of significantly slower advancement in latest years. In advance of an initial community presenting that could arrive as shortly as this 12 months, the corporation is racing to solidify its situation in new markets that it has underexploited to day, though striving to generate up profits to charm to a new set of investors.

Rene Haas, Arm’s incoming chief executive, told the Monetary Instances that its solutions had been now “far additional competitive” in details centers and automobiles than when SoftBank acquired the Cambridge-dependent firm.

“Making trade-offs about exactly where to commit, where not to invest… those are the trade-offs that public organizations and even private organizations have to do each and every working day,” he stated. “The corporation is in great shape.”

When Son spearheaded the $31 billion buy of Arm, he noticed it as a wager on the future of the total engineering field, which was crystallizing at that time about the IoT strategy. He proceeded to drive the government crew firmly on the system to planning chips for this long run of device connectivity.

Five-and-a-50 percent decades later, it has turn into ever more apparent that the IoT gamble was a expensive misadventure. What’s more, it distracted Arm from attacking Intel’s dominance in the significantly larger sized facts center sector.

As Son’s vision collided with truth, SoftBank quietly revised its market calculations. A presentation from 2018 forecast that by 2026, the IoT controller current market would be worth $24 billion, and the server market $22 billion.

But, a equivalent presentation from 2020 predicted that by 2029, the IoT chip sector would arrive at only $16 billion, though the server market—of which Arm experienced so much only captured a 5 percent share—would get to $32 billion. The Japanese technological innovation group also revised down its estimate of the value of the IoT market, from $7 billion in 2017 to $4 billion in 2019.

Tudor Brown, who co-launched Arm in 1990 and was an govt at the organization for 22 decades, explained its major financial investment in IoT as “strange” offered that “there was in no way likely to be any funds in that industry.” He included: “Focusing on that, they did not aim on the big prize, which was the server.”

In Arm’s regulatory filings in December, the business created a robust circumstance versus pursuing an IPO and in favor of a Nvidia sale, outlining how shareholder tension could stifle the company’s potential to commit in the details heart and Personal computer marketplaces, which had been “difficult to crack” and in which it had produced only “limited inroads.” General public-marketplace investors would “demand profitability and performance,” indicating charge-cutting and a deficiency of economic firepower to spend in ground breaking new companies, Arm’s submitting additional.

“We often felt that the Nvidia acquisition would give us a superb opportunity to devote and do much more,” mentioned Haas. “Now that we are on to the [IPO], I really feel pretty fantastic about our prospective customers.”

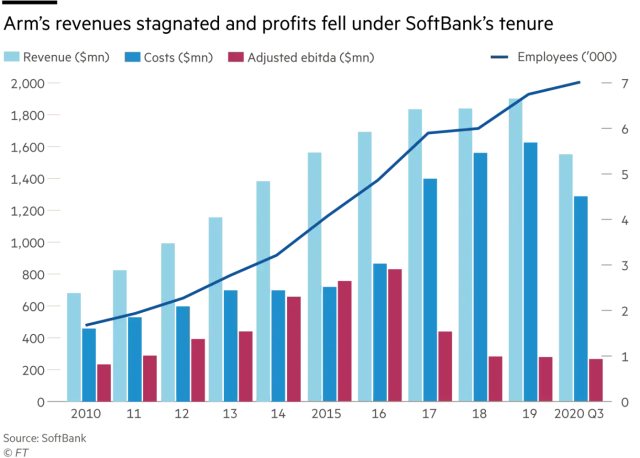

Son also underestimated just how pricey providing innovation in semiconductors can be, even while Arm does not manufacture its have silicon. Arm’s costs increased from $716 million in 2015 to $1.6 billion in 2019, according to SoftBank knowledge. Revenues attained 20 percent to $1.9 billion although profits plunged virtually 70 % to $276 million by 2019.

FT, Softbank

Arm has additional a short while ago begun to program-right, investing additional intensely in the growing server and Pc market place over the previous four a long time, winning allies this sort of as Amazon Internet Companies, which is now on the third technology of its Arm-primarily based Graviton chip, and Apple, which is shifting its full array of Mac personal computers from Intel to its have M1 processors, created on Arm’s styles.

Haas conceded: “While IoT is nevertheless a vastly essential location to us, we are pretty, extremely targeted on the computer system room,” he said, referring to chips for servers and PCs. He refused to disclose what part of Arm’s revenues arrived from places outside its main mobile company, citing the “heavy regulatory process” surrounding the Nvidia offer.

Arm’s executives argue they are only now commencing to reap the rewards of strategic investments manufactured several many years in the past. Arm’s chip layouts are accredited to semiconductor providers and digital producers as they begin to produce new solutions it can just take a number of a long time for first style wins to translate into royalties from product or service revenue.

The company’s royalty profits, which accounts for additional than fifty percent of its full profits, rose 22 per cent in the previous nine months, supporting Haas’ statements of a turnaround. These were being “numbers compared with Arm has ever observed ahead of and larger than it was pre-SoftBank,” he said.

“Masa experienced usually claimed that owning Arm be a public business some day was absolutely the purpose,” Haas stated, incorporating that now the Nvidia deal experienced fallen by means of, Arm was “back to the original Program A.”

© 2022 The Monetary Moments Ltd. All legal rights reserved Not to be redistributed, copied, or modified in any way.